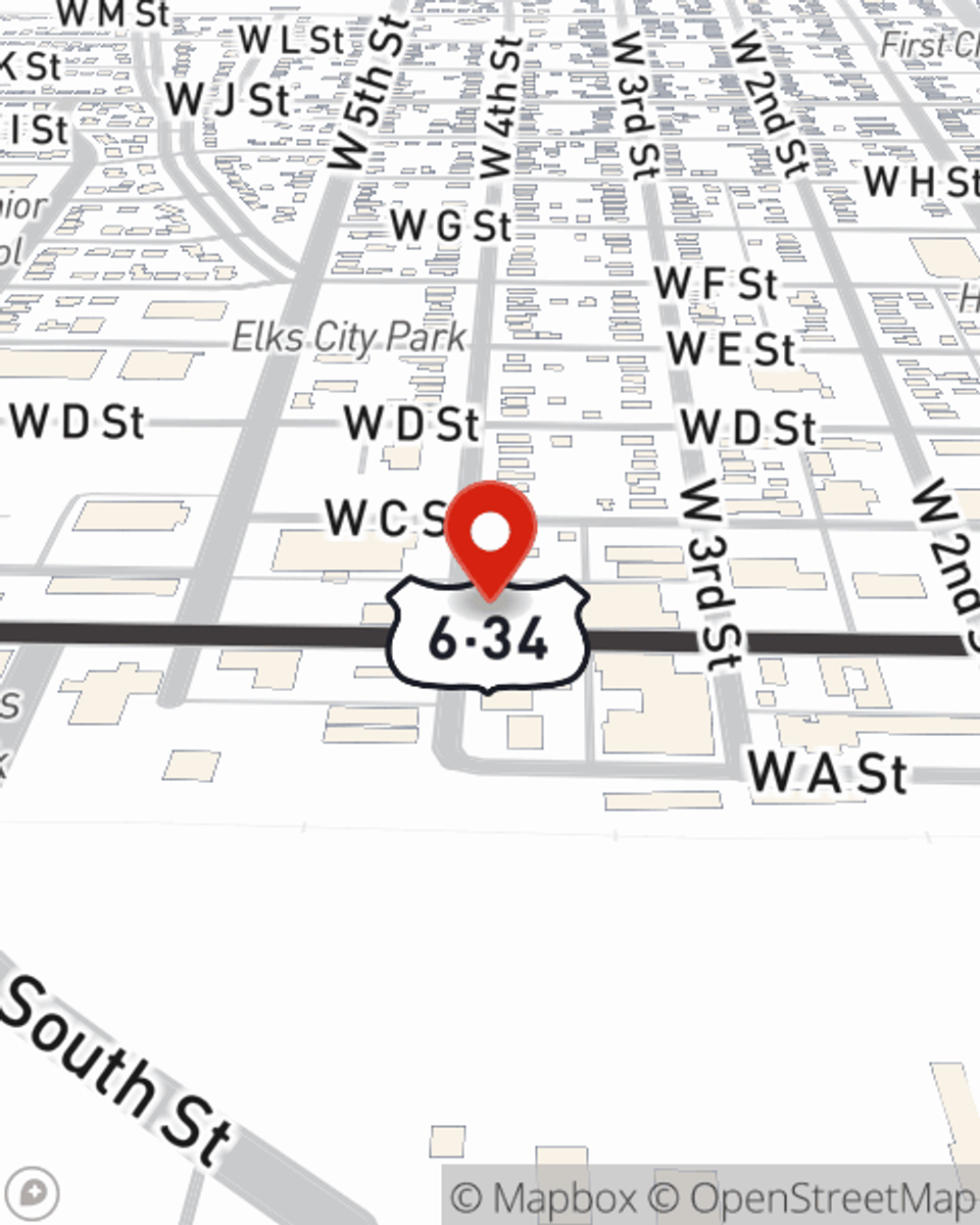

Business Insurance in and around McCook

Calling all small business owners of McCook!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to face those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including extra liability coverage, a surety or fidelity bond and business continuity plans, among others.

Calling all small business owners of McCook!

Cover all the bases for your small business

Protect Your Future With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a floral shop, an art school or a camping store. Agent Kristie Nickel is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Get right down to business by calling or emailing agent Kristie Nickel's team to talk through your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Kristie Nickel

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.